BTC Price Prediction: $135K Target in Sight as Accumulation and Technicals Align

#BTC

- Technical Strength: MACD bullish crossover and Bollinger Band squeeze signal breakout potential toward $116K.

- Institutional Demand: MicroStrategy and public companies now hold over 1.2% of BTC's circulating supply.

- Macro Tailwinds: Record $142T global money supply fuels store-of-value demand for scarce assets like Bitcoin.

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge

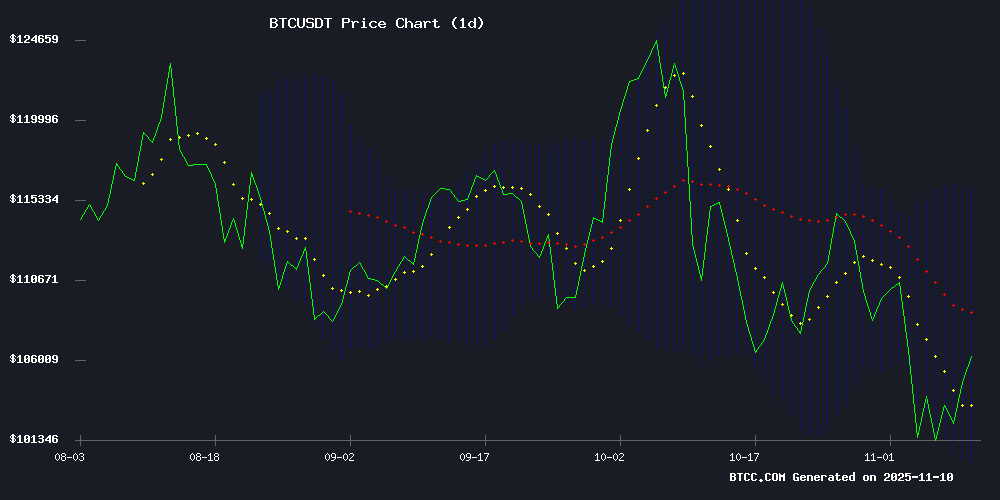

According to BTCC financial analyst Mia, Bitcoin (BTC) is currently trading at $105,958.67, slightly below its 20-day moving average (MA) of $108,004.91. The MACD indicator shows a bullish crossover with the MACD line at 3,657.39 above the signal line at 2,154.77, suggesting upward momentum. Bollinger Bands indicate volatility, with the price near the middle band, hinting at a potential rebound toward the upper band at $116,045.57.

Market Sentiment: Institutional Accumulation Fuels BTC Optimism

BTCC analyst Mia highlights strong bullish sentiment driven by institutional activity. MicroStrategy's continued bitcoin accumulation, BlackRock's reaffirmed conviction, and Galaxy Digital's adjusted $120K target reflect long-term confidence. The rebound above $100K aligns with technical recovery signals, while global liquidity expansion ($142T money supply) and growing interest in tokenized assets further support the bullish case.

Factors Influencing BTC’s Price

Michael Saylor's MicroStrategy Doubles Down on Bitcoin Accumulation Amid Market Downturn

MicroStrategy continues its relentless Bitcoin acquisition strategy despite recent price volatility. The company announced plans to purchase an additional 397 BTC this week, expanding its treasury holdings to 641,205 BTC at an average cost basis of $74,064 per coin.

August saw the firm's largest recent investment—$2.46 billion for 20,945 BTC at $117,526 per unit. Current prices hovering around $106,064 represent a paper loss, but CEO Michael Saylor remains unfazed. His terse "Best continue" statement signals unwavering commitment to the corporate Bitcoin accumulation strategy.

The company maintains strict capital preservation rules, refusing to issue shares below 2.5 times net asset value. This disciplined approach prevents shareholder dilution while enabling continuous Bitcoin purchases during market dips.

Bitcoin Rebounds Above $100K as Technicals Signal Recovery Toward $104K and $135K Targets

Bitcoin has reclaimed its footing above the $100,000 psychological threshold after a volatile week of trading. The cryptocurrency now trades near $101,800 as of November 9, 2025, demonstrating resilience amid shifting macroeconomic winds. Market technicians highlight a decisive trendline breakout and strong order-block reaction—two factors that often precede sustained upward momentum.

Liquidity conditions have improved alongside renewed institutional interest, with Bitcoin's market capitalization holding steady at $2.03 trillion. The rebound follows a consolidation phase between $99,376 and $103,956, suggesting bears have temporarily exhausted their downward pressure. Analysts at Bitstamp observe growing accumulation patterns among long-term holders, a historically reliable indicator of impending price appreciation.

Bitcoin Treasury Bear Market Shows Signs of Reversal as Short Seller Exits Position

Renowned short seller James Chanos has closed his 11-month hedged trade involving MicroStrategy ($MSTR) and Bitcoin, signaling a potential shift in sentiment toward Bitcoin-linked equities. The unwind of institutional short positions often precedes trend reversals, suggesting the worst may be over for Bitcoin treasury companies.

Pierre Rochard, CEO of The Bitcoin Bond Company, observes that the bear market for these firms is "gradually coming to an end." While volatility persists, the reduction in short pressure provides a clear technical signal for market participants. "Expect continued volatility, but this is the kind of signal you want to see for a reversal," Rochard noted.

The Bitcoin treasury sector has faced significant pressure in recent months, with stocks trading well below yearly highs. Analysts had warned of a bubble in Bitcoin-correlated equities, but the closure of high-profile short positions now hints at renewed institutional confidence.

Bitcoin Power Law Predicts $142,000 Fair Value and Bullish Breakout

Bitcoin's fair value sits at approximately $142,000 according to the Bitcoin Power Law model, signaling potential for a significant upward movement. Analyst Adam Livingston highlights that BTC's current price formation—rarely lingering near the lower bound of its historical channel—often precedes substantial rallies.

The model projects a December 2025 upper target of $512,000, with a lower constraint around $50,000. Historical patterns suggest Bitcoin typically trades at or above fair value, reinforcing bullish sentiment. Market caution persists, but the long-term regression trend indicates a possible breakout phase.

CZ Challenges Gold's Transparency Amid Rising Interest in Tokenized Assets

Binance founder Changpeng Zhao (CZ) has reignited the debate over gold's verifiability, contrasting its opaque audit processes with blockchain's transparent ledger systems. The discussion gained traction as market participants questioned why Fort Knox's gold reserves undergo infrequent audits while Bitcoin offers real-time, public verification.

Tokenized gold products face skepticism from crypto advocates like CZ, who argue they perpetuate legacy trust issues rather than solving them. Meanwhile, demand for both physical and digital gold exposure rises amid financial market uncertainty, with prices climbing as investors seek stability.

The clash highlights a fundamental divide: traditional assets rely on institutional trust mechanisms, while cryptocurrencies operate on mathematically enforced transparency. This tension grows more pronounced as institutional players explore blockchain-based commodity tokenization.

Cathie Wood Adjusts Bitcoin Outlook Amid Stablecoin Expansion

Ark Investment Management has revised its 2030 Bitcoin price target downward from $1.5 million to $1.2 million, a adjustment reflecting evolving market dynamics rather than diminished confidence. Cathie Wood attributes the change to stablecoins increasingly fulfilling roles once envisioned for Bitcoin—particularly in payments and as dollar proxies in emerging markets.

The $1.2 million forecast still assumes significant Bitcoin adoption: displacing gold's market capitalization, becoming a strategic reserve asset, and gaining institutional traction. Wood's tempered optimism coincides with three structural shifts: the explosive growth of on-chain dollar equivalents like USDT, rising risk-free rates, and Bitcoin's maturation via ETF infrastructure.

Stablecoins now command a $300 billion market cap, with Tether and peers absorbing Treasury bills at scale. These digital dollar proxies are reshaping global payment rails, displacing traditional correspondent banking networks.

Global Money Supply Hits Record $142 Trillion, Fueling Crypto Market Speculation

The global broad money supply surged to a record $142 trillion in September, marking a 6.7% year-on-year increase. China, the EU, and the U.S. are driving this unprecedented expansion, with implications for Bitcoin and the broader cryptocurrency market.

New York Fed President John Williams hinted at a potential return to Quantitative Easing (QE), signaling the central bank may end Quantitative Tightening (QT) and resume asset purchases to support market stability. Analysts anticipate the Fed could restart bond acquisitions as early as Q1 2026, a move that would significantly impact global liquidity.

Macro investor Raoul Pal framed the outlook starkly: "You just need to get through the Window of Pain and The Liquidity Flood lies ahead." The ripple effects of this monetary expansion are already being felt across financial markets, with cryptocurrencies poised to benefit from increased capital flows.

Michael Burry Bets $1.1B Against AI Titans Nvidia and Palantir, Drawing Parallels to Crypto Skepticism

Michael Burry, the investor famed for predicting the 2008 housing crash, has placed a $1.1 billion bet against AI giants Nvidia and Palantir. His hedge fund's massive put options signal a conviction that the AI boom mirrors past market bubbles—a stance evoking debates once directed at Bitcoin during its early volatility.

Palantir CEO Alex Karp dismissed Burry's short position as "absurd," arguing AI leaders are the ones "making all the money." The clash highlights a divide between Silicon Valley optimism and Burry's contrarian instincts, reminiscent of crypto's clash with traditional finance.

BlackRock Reaffirms Bitcoin Conviction Amid Market Uncertainty

BlackRock's latest SEC filing reveals unwavering confidence in Bitcoin's long-term value proposition, despite its recent failure to sustain the $100,000 level. The asset manager positions BTC as a multi-decade structural play, emphasizing network growth over short-term price action.

Bitcoin's adoption curve remains central to BlackRock's thesis. With 300 million users achieved in just 12 years—faster than mobile phones or the early internet—the firm sees BTC's network effects compounding faster than its price reflects. This growth narrative persists even as market participants question institutional stamina during pullbacks.

The filing frames Bitcoin's volatility as secondary to its accelerating strategic value. BlackRock highlights declining confidence in traditional monetary systems as a catalyst for BTC's maturation, suggesting current price weakness belies deeper institutional adoption trends.

Galaxy Digital Cuts Bitcoin Year-End Target to $120,000 Amid Market Correction

Bitcoin faces mounting bearish pressure as Galaxy Digital slashes its year-end price target from $185,000 to $120,000. The cryptocurrency has retreated 14% from its recent $115,000 peak, with technical analysts warning of potential downside toward $76,000 if key support levels fail.

The market cap holds at $2.03 trillion despite the pullback, with Bitcoin maintaining 59.18% dominance. Trading volumes remain robust at $54.95 billion as debates continue about Bitcoin's role versus quantum computing and gold.

Technical charts show BTC hovering near a critical relief zone between $105,000-$108,000. Analysts caution that a breakdown below $94,000 could accelerate losses, while a close above $111,500 might signal trend reversal potential.

Bitcoin Accumulator Addresses Double Amid Strong Long-Term Confidence

Bitcoin accumulator addresses have surged to 262,000, more than doubling over the past two months. These wallets absorbed 375,000 BTC in just 30 days, with a single-day spike of 50,000 BTC on November 5. The trend underscores unwavering conviction among long-term holders despite ETF outflows and short-term price pressures.

CryptoQuant analyst Darkfost tracked the acceleration, noting the monthly average of accumulator addresses rocketed from 130,000 to 262,000. Whale activity now dominates supply absorption, with buying velocity hitting record levels even as retail participation lags. 'This isn't speculation—it's capital positioning for the next cycle,' remarked one OTC desk trader.

Is BTC a good investment?

Yes, Bitcoin presents a compelling investment opportunity based on current technicals and market dynamics:

| Metric | Value | Implication |

|---|---|---|

| Price vs. 20MA | -1.9% below | Mean-reversion potential |

| MACD | Bullish crossover | Uptrend confirmation |

| Bollinger Bands | Mid-band test | Volatility expansion likely |

Institutional accumulation (MicroStrategy, BlackRock) and macroeconomic tailwinds suggest BTC is transitioning to a 'buy-the-dip' regime. The $104K–$135K technical targets align with Galaxy Digital's $120K year-end outlook.